Real estate investment is something that individuals and companies consider to be one of the top investment opportunities. However, there are now some modern investment options including real estate tokenization which are well worth considering instead of traditional real estate investments. By learning about the pros and cons of real estate tokenization, investors can decide if this is the right option for them moving forward. Our team will be here to help at any point and answer any questions you might have about real estate tokenization in the future as well.

- What is real estate tokenization?

- Pros of real estate tokenization

- Traceable, Transparent, and Trustworthy

- Secured and excellent fraud protection

- Legally collateralized by real estate assets

- Complete control of the investment funds

- Invest in your favorite projects

- Global opportunities

- Direct transfer without costly intermediaries

- Lowest transaction costs

- What you must look for

- Are the assets on the platform managed by a licensed and regulated operator?

- Is the manager reputable and regulated by a respected Central Bank?

- Are your liquid funds held by a regulated, well managed and funded bank?

- Is the manager transparently disclosing how the assets are held and what the risks of the investment are?

What is real estate tokenization?

Before we can fully explore the pros and cons of real estate tokenization, it’s important to understand what this term means in the first place. When it comes to real estate tokenization, this term is used to describe the process of creating virtual tokens which represent ownership of a real estate asset. Tokenization is now being used for a wide range of assets, and it has many benefits over traditional investment opportunities. It offers an opportunity to securitize real assets, dividing a property into shares that can be sold to investors. This provides a flexible and accessible solution for both first-time and experienced investors, which we will be excited to assist you with in the future.

Pros of real estate tokenization

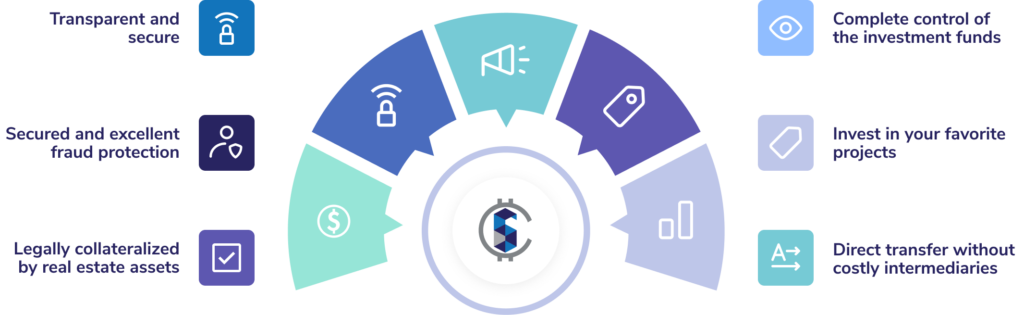

Traceable, Transparent, and Trustworthy

These three benefits work together to make real estate tokenization a safe and effective investment opportunity for investors. Firstly, real estate tokens are easy to trace, and every aspect of the transaction is transparent. It’s a trustworthy solution that offers you peace of mind and security, knowing that your investments are protected. You can feel safe and secure knowing your money is protected and that you can trace your tokens at any time if you need to.

Secured and excellent fraud protection

When dealing with any modern investment opportunity for the first time, one of the biggest concerns we hear about is security. Real estate tokenization is a safe and secure option that offers excellent protection from fraud. The systems which are used to create these tokens will safeguard your tokens and finances, offering a reliable solution that is usually safer than traditional investment opportunities. Every part of the process is traceable, so investors can be sure they know the value and number of tokens they hold at any one time.

Legally collateralized by real estate assets

When using real estate tokens, your investment will be legally collateralized by real estate assets. This is one of the top things to keep in mind when looking at the pros and cons of real estate tokenization. Each real estate token is legally collateralized and is associated with a physical piece of real estate. Many people fear they are investing in something virtual, but that’s not the case at all when you invest in real estate tokens. You’ll have a physical piece of property associated with each token, which you will have personally selected to invest in if that’s the route you would prefer to take. With properties available to suit all needs and budgets, it’s very similar to investing in physical real estate.

Complete control of the investment funds

Many of us want to ensure we have full control over our investments, and that’s something we completely understand. Real estate tokenization gives you more control than you would have when dealing with traditional real estate investments which you might have been involved with in the past. You’ll be able to check and control your tokens from anywhere in the world and at any time of the day or night. You’ll feel like you know exactly how your portfolio looks at any time, setting yourself up for success in the future.

Invest in your favorite projects

As with any type of investment opportunity, you still get the chance to invest in a wide range of projects when using real estate tokens. This is one of the top things to consider when looking at the pros and cons of real estate tokenization, and no matter your budget, you’ll find a project that excites you.

Global opportunities

One of the top benefits of real estate tokenization is that you can now invest anywhere in the world from the comfort of your home. Global opportunities can appear at any time, and you’ll find that you have a diverse range of projects to consider. This makes investing more accessible to the wider population, allowing people who might never have considered investing in real estate the opportunity to do so in the near future.

Direct transfer without costly intermediaries

For anyone who is considering transferring their real estate tokens, this can be done without costly intermediaries. This helps to minimize the costs associated with investments, making it a better opportunity than other solutions you might otherwise be considering.

Lowest transaction costs

Finally, when considering the costs of real estate investment, you’ll find that real estate tokens have the lowest transaction costs on the market. This means they are a great option for anyone who is investing for the first time or who is worried about the hidden costs that are sometimes experienced when dealing with this type of transaction.

What you must look out for

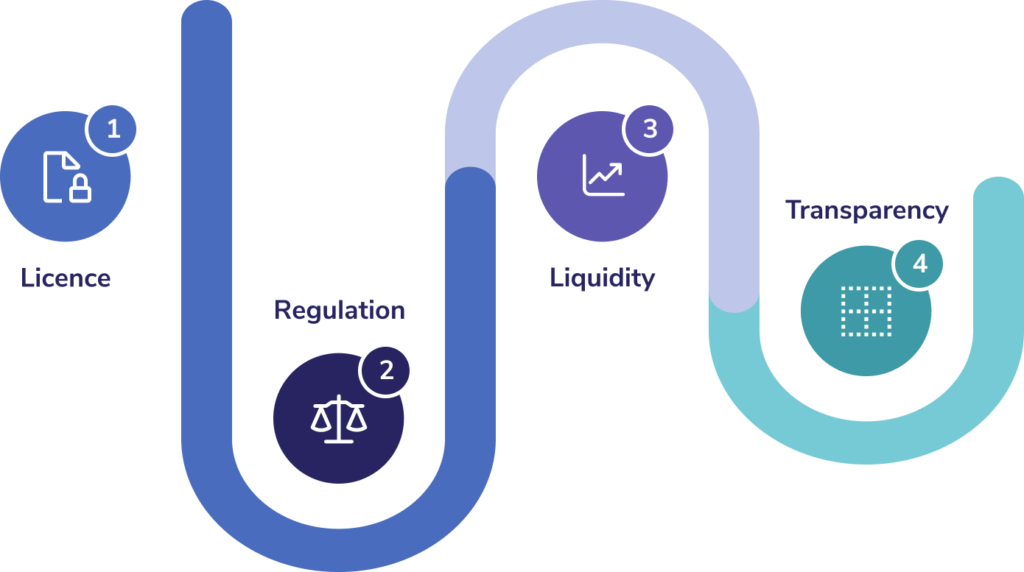

Are the assets on the platform managed by a licensed and regulated operator?

With so many opportunities available online today, it’s critical that you thoroughly consider the pros and cons of real estate tokenization. The first thing we always encourage clients to check is whether the assets on the platform they are using are managed by a licensed and regulated operator. If you don’t know where to start or how to check this, our team will be here to advise you about this. Make sure you don’t put your hard-earned cash into any investments that might not be secure. You never know how this could backfire in the future, leaving you in a worse position than you originally expected.

Is the manager reputable and regulated by a respected Central Bank?

Continuing on from the above consideration, you’ll want to ensure the manager is regulated by a respected Central Bank and that they have a good reputation. It’s easy to be fooled by a company’s website or false testimonials, so make sure you look up reviews of their services online before going any further with your investment. This regulation is a good sign that your investment will be safe and secure and that you’ll be in good hands when opting for this investment opportunity.

Are your liquid funds held by a regulated, well managed and funded bank?

Liquid funds must also be held by a regulated and funded bank. You need to know that your investment is in safe hands, otherwise, you could risk your financial future. Don’t be afraid to ask questions before making an investment, as you don’t want to leave this until it’s too late. Our team will be happy to guide you throughout the process and ensure any transaction you make is safe and secure.

Is the manager transparently disclosing how the assets are held and what the risks of the investment are?

This is the final critical thing to consider when investing in real estate tokens. The manager shouldn’t be afraid to disclose how the assets are held. They should be open to discussing the risk of the investment so you aren’t left with any nasty surprises further down the line. The more open a company is about discussing the opportunity with you, the more likely you’ll be in good hands. If you find a manager to be wary about answering any of your questions or unable to give you an answer, that’s a good sign that you need to turn elsewhere. As with any transaction you undertake in life, always go with your gut feeling to ensure you aren’t wasting your money and time with any future investment.

As you can see, there are many pros and cons of real estate tokenization. The pros certainly outweigh the drawbacks of this type of investment, which is why we are so passionate about the future of real estate tokens. They are only continuing to gain more attention each year, and we can’t wait to see how this industry grows as more people start investing in this form of real estate. You will enjoy a safe and secure investment opportunity, which you can guarantee by asking the questions we shared above. By keeping these areas in mind, you can be sure you protect yourself financially for many years to come.

Are you ready to start investing in real estate tokens? If so, our team at Safere will be here to support you on this journey. We are passionate about this type of innovative investment opportunity and the benefits it can offer investors in the future. Contact us today for more information and to get started. We’ll be here to support you and will be happy to answer any questions you might have along your journey.