SafeRE is forging into the promising realm of real estate investing, embracing private credit as a powerful complement to traditional class assets. SafeRE believes investors can build more durable portfolios by investing in private credit, offering passive income generation, return enhancement, and diversification.

What is Private Credit?

Private debt, or private credit, is the provision of debt finance to companies from private lenders like individuals or private debt funds, rather than banks, bank-led syndicates, or public markets. In established markets, such as the US and Europe, private debt is often used to finance buyouts, though it is also used as expansion capital or to finance acquisitions.

Private debt expanded rapidly after the Global Financial Crisis (GFC), when banks, due to their capital constraints, curtailed their leveraged lending and concentrated corporate operations on larger clients, creating a gap in the market that private fund lenders filled.

Private debt funds pursue a range of strategies, for example, direct lending, venture debt, or special situations financing. They characterise their activities by the type of debt provided which includes mainly senior, junior, or mezzanine loans. Lending private debt can be to both listed or unlisted companies, as well as to real assets such as infrastructure and real estate.

History

Bank lending continues to be a conventional source of debt, albeit with reduced activity following the Global Financial Crisis (GFC) in 2008 and the implementation of stricter banking regulations.

In the aftermath of the GFC, traditional lenders scaled back their financing, resulting in an opening in the market for alternative sources of lending, such as private debt fund managers.

Previously considered a subcategory of private equity investing, debt strategies have since evolved into a distinct and established asset class after the crisis. This transformation underscores the resilience and adaptability of the private debt market in responding to changing financial landscapes.

The Evolution of Private Credit

Private credit investing has gained momentum in recent times compared to other asset classes.

PitchBook estimates that private debt now makes up about 10% to 15% of total assets under management (AUM) in the private markets, ranking it as the third-largest asset class after private equity and real estate.

Non-bank lenders have become more popular as banks tightened their debtor requirements. Many borrowers, especially SMEs, turned to non-bank lenders for financing. Before 2000, most loans for small and medium-sized businesses came from banks. However, non-bank lending has grown significantly since then.

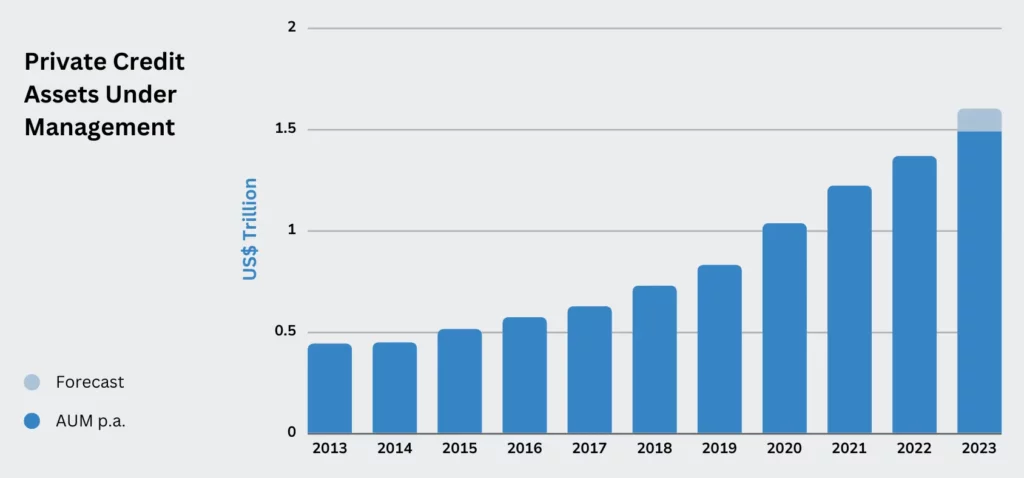

Private credit assets under management (AUM) have surged nearly threefold:

Source: Preqin

- Rising from US$342 billion in December 2011 to a substantial US$1.4 trillion as of June 2022 [1].

- Experts project a further growth trajectory, with the AUM anticipated to reach a staggering US$2.3 trillion by 2027 [2].

- The number of private credit funds has also doubled in the last decade, increasing from 104 in 2010 to 222 by 2022.

- Correspondingly, the annual aggregate capital raised has shown a significant upswing, climbing from US$44.6 billion in 2010 to an impressive nearly US$210 billion as of the end of 2022 [3].

This is driven by factors such as banks’ retrenchment, the preference for privately negotiated, customized loans by companies owned by private equity investors, and investor’s search for higher yields.

The Players in Private Credit Market

In private credit, investors play the role of lenders, directly negotiating and transacting deals with borrowers.

The loans or bonds are not publicly traded. Like most loans, borrowers in private debt repay the principal and interest over a specified period, following agreed-upon terms. For bonds, regular coupon payments are made to the investors.

Private debt borrowers are often small and medium-sized enterprises (SMEs) without investment-grade credit ratings. These listed or unlisted companies typically have EBITDA ranging from around US$3 million to US$100 million per year, averaging about US$30 million.

These funds are commonly used by companies for financing acquisitions, developing real estate, building infrastructure, expanding their business, or enhancing operations. Private credit is not limited to companies; it also extends directly to assets like real estate and infrastructure.

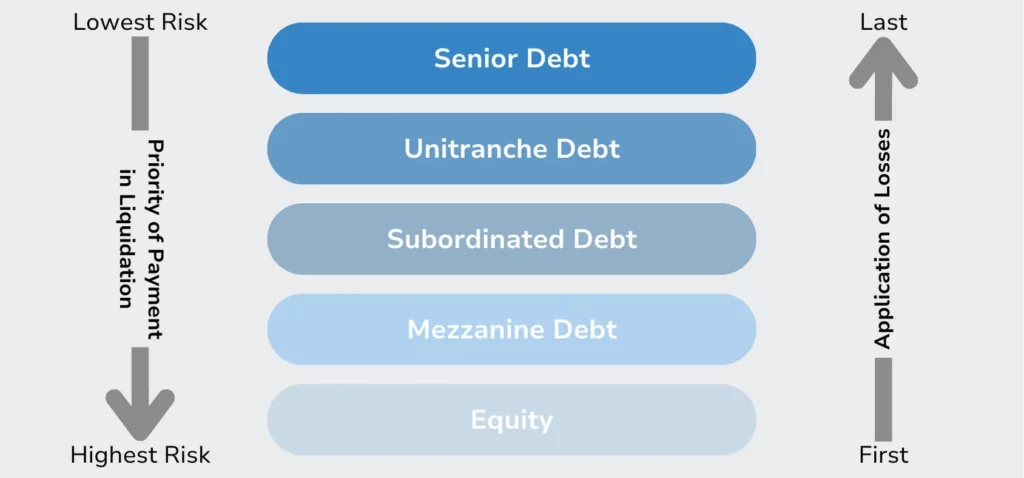

Understanding the Capital Structure

Capital structure refers to how a company is financed, including the mix of debt and equity on its balance sheet. Senior debt is repaid first and considered low risk, while equity is repaid last and seen as high risk. Understanding capital structure is essential for assessing risk and financial stability.

Source: Preqin

Senior Debt

Senior debt is a type of loan that takes precedence for repayment in the unfortunate event of borrower default. It holds a higher priority within the capital structure compared to more junior debt and is the security in the capital structure, which suffers losses last. One of its key features is that it is usually secured by collateral or assets, granting the lender a “first lien” claim over them. This security measure contributes to its lower risk profile when compared to junior debt or equity. Due to its lower risk, lenders often offer senior debt at more favourable interest rates than those charged for junior or subordinated debt. This combination of priority and reduced risk makes the senior debt an attractive option for both borrowers and lenders seeking stability and security in their financial transactions.

Unitranche Debt

Unitranche debt is a unique financial instrument that combines both senior and subordinated debt into a single package. Typically issued by one debt provider, it is commonly utilized to facilitate leveraged buyouts. The primary purpose of unitranche debt is to streamline the debt structure, allowing a single lender to fulfil the entire debt requirement. As it encompasses elements of both senior and subordinated debt, the interest rate charged for unitranche debt often falls between the two, providing a balanced and attractive option for borrowers seeking simplified financing solutions at still a fairly low-risk level.

Subordinated Debt

Subordinated debt, also known as ‘junior debt,’ refers to a loan that takes a backseat to senior debt in the event of bankruptcy. It holds a lower priority in the capital structure, making it riskier than senior debt and consequently attracting a higher interest rate. Positioned above equity in the capital structure, lenders are repaid before shareholders or owners, providing an additional layer of security to lenders in case of financial distress.

Mezzanine Debt

Mezzanine debt, also referred to as ‘hybrids,’ represents a unique blend of equity and debt financing. This debt capital may carry the right to convert into equity ownership if the borrower faces default. Mezzanine debt would for instance contain ’embedded equity options’ or ‘kickers,’ such as stock call options, rights, or warrants. Unlike secured debt, mezzanine debt is often unsecured and lacks collateral, resulting in a higher interest rate to compensate for the increased risk.

Equity

Equity represents the shares of a company and holds the lowest priority in the capital structure for repayment. As a result, it carries the highest risk for shareholders in the unfortunate event of bankruptcy. However, equity also offers the potential for higher returns, as shareholders participate in the company’s profits and growth. Balancing risk and reward, equity investment requires careful consideration and risk assessment on the part of investors.

Private Credit Investment Strategies

Most institutional investors directing capital towards private debt primarily target unlisted private debt funds. These funds come in various forms, each with distinct strategies, such as direct lending or fund of funds.

Additionally, they vary based on the type of debt offered, ranging from senior debt to mezzanine debt. This diverse array of unlisted private debt funds allows investors to tailor their allocations to suit their specific risk preferences and investment objectives.

- Direct Lending: In this investment, non-bank lenders play a vital role by extending loans to small and medium enterprises (SMEs). Among them, direct lending funds specialize in issuing loans directly to companies. Depending on the fund’s strategy, they offer various types of debt, such as senior or subordinated debt. This tailored approach allows SMEs to access financing that aligns with their specific needs and financial requirements.

- Distressed Debt: Investors engaging in distressed debt focus on purchasing the debt of companies already in bankruptcy or those likely to face bankruptcy soon. These distressed debt funds operate similarly to direct lending funds but exclusively target distressed opportunities. The debt issued in these cases tends to be senior, holding a high position in the capital structure, as the risk of liquidation is substantial. This strategy offers investors the potential for attractive returns as distressed companies recover and regain financial stability.

- Mezzanine Financing: A distinctive blend of equity and debt finance. Mezzanine funds specialize in issuing mezzanine debt to companies, which may come with conversion rights to equity and may contain embedded equity options in the event of borrower default. This versatile form of financing provides companies with a flexible funding option that bridges the gap between traditional debt and equity, offering potential benefits for both borrowers and investors.

- A Private Debt Fund of Funds: It is a private pool of institutional investor capital that strategically invests in multiple private debt funds. These fund of funds allocate their investments across various third-party debt funds based on specific strategies. By doing so, they offer institutional investors the advantage of greater portfolio diversification. This approach allows investors to spread their capital across a range of private debt opportunities, mitigating risk and enhancing the potential for attractive returns.

- A ‘Special Situation’ Loan: It is granted based on factors other than the underlying company fundamentals. Special situations funds target companies whose value may be influenced by specific events, such as company spin-offs, mergers & acquisitions, or tender offers. These funds encompass both debt and equity investments, offering a diversified approach to capitalizing on unique investment opportunities arising from special circumstances.

- Venture Debt: A loan tailored for start-up or early-stage companies, serving as growth capital for equipment financing or accounts receivable finance. This financing option provides crucial support to fuel the expansion and development of young businesses, enabling them to acquire necessary equipment and manage accounts receivable efficiently.

Private debt encompasses various important aspects, including Collateralized Loan Obligations (CLO) and Business Development Companies (BDC):

- Collateralized Loan Obligation (CLO): CLO serves as an investment instrument, backed by a pool of debt with different credit ratings and repayment structures. Investors gain exposure to a diversified portfolio of existing bank loans and receive scheduled interest payments from these loans. However, in the event of borrower default, investors assume a significant portion of the risk.

- Business Development Company (BDC): A tax-efficient, publicly traded private debt fund based in the US, structured as a corporate fund. BDCs focus on supporting small companies in their early stages of development, like private venture capital and venture debt funds. These companies are publicly listed on stock exchanges and typically offer short-term unsecured loans ranging from $2 million to $50 million. Additionally, BDCs may take equity positions in the companies they invest in, offering investors opportunities to participate in potential growth.

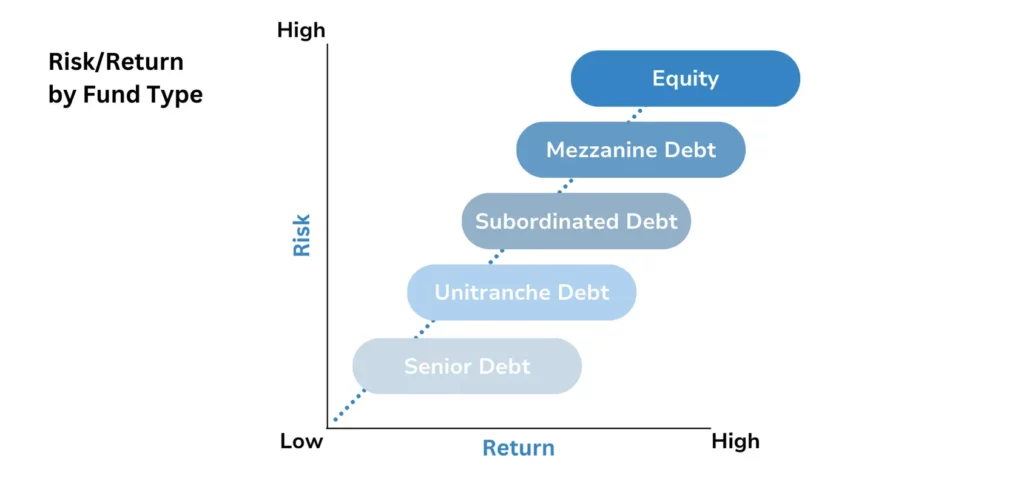

Risks and Returns in Private Credit

The risk and return profiles of various private debt strategies are influenced by the specific investment and its position within the capital structure.

Strategies that entail lower risk typically yield lower returns, whereas those with higher risk potential often offer the prospect of higher returns. As investors assess their risk tolerance and investment objectives, understanding the nuances of each strategy becomes essential in making informed decisions that align with their financial goals.

Source: Preqin

Why Invest in Private Debt?

Private debt is widely recognized as a low-risk investment option when compared to other alternative asset classes, making it an appealing alternative to traditional fixed-income investing.

Investors often choose to allocate capital to private debt through commitments to unlisted private debt funds. These funds have gained popularity due to their ability to offer attractive risk-adjusted returns, especially in a low interest rate environment. The combination of lower risk and potentially higher returns makes private debt a favoured choice among investors seeking stable and profitable investment opportunities.

A conservatively managed private debt portfolio offers compelling advantages for institutional investors:

- Portfolio Diversification: Private debt provides opportunities for diversifying investment holdings, and enhancing risk management.

- Low Correlation: It exhibits a low correlation to public markets, providing potential for portfolio stability and reduced market sensitivity.

- Attractive Risk-Adjusted Returns: Private debt delivers appealing risk-adjusted returns, especially in a low-interest rate environment, fostering profitability.

- Predictable and Contractual Returns: Returns are predictable and contractual, derived from interest rates charged, ensuring consistency in income streams.

- Lower Risk than Private Equity: Debt’s higher capital structure positioning translates to lower risk exposure compared to private equity.

- Below Par Value Opportunities: Investors can acquire debt in companies at below par value, presenting advantageous buying opportunities.

- Alternative to Fixed Income: Private debt serves as a compelling alternative to fixed-income investments, offering a balance of stability and returns.

Invest in Private Credit with SafeRE

From this guide, we learned that investment in Private Credit Market can be a valuable addition to a mature portfolio, complementing private equity, as it offers attractive risk-return profiles, diversification benefits, and income-generating abilities with lower volatility. Most returns come from reliable income streams, and investors can benefit from predictable and contractual returns based on the interest rate charged. Moreover, private credit’s floating rates allow investors to capitalize on rising interest rates, delivering higher returns compared to traditional fixed-income and equity markets.

Foreseeing that, SafeRE has revolutionised direct access to these quality real estate investments by reducing fees and offering a seamless and transparent investment process. SafeRE’s real estate investment platform provides access for investors to funds that exhibit steady performance over the years, with lenders enjoying flexibility in setting preferred lending terms and greater influence in structuring loans with collateral and financial covenants to mitigate risks for their investment.

SafeRE introduces more efficient ways to build your wealth. For more information on SafeRE and Private Credit investing, feel free to contact us for a consultation or directly access more innovative financing solutions and products on the SafeRE platform.

Resources [1] [2] [3] - “Private Credit – The Next Key Driver of Growth in Private Markets” (Speech by Mr Lim Cheng Khai, Executive Director, Financial Markets Development Department, Monetary Authority of Singapore, at the Private Debt Investor’s APAC Forum 2023)

Disclaimer: This is not an advertisement making an offer or calling attention to an offer or intended offer for the purchase or sale of securities, units in a collective investment scheme or any other financial product. Neither this article nor anything contained herein shall form the basis of any contract or commitment whatsoever and should not form the basis of any investment decision and should not be considered as advice or recommendation by SafeRE Pte. Ltd. (“SafeRE”), its affiliates, representatives, directors, managers officers, employees, agents, to acquire any investment product.

The information contained herein is for informational purposes only and should not be construed as financial advice or a recommendation or an endorsement of any particular investment or investment portfolio or strategy. Nothing in this material has been independently verified to ensure its accuracy and fairness. Nothing in this material should be relied upon as a representation or warranty on any matter. In considering the suitability of any investment or other product mentioned herein, recipients of this material should bear in mind that past performance is no guarantee of future results, and any forward-looking statements, predictions or projections are subject to market influence and matters outside the control of SafeRE. Recipients should consult their own advisors.

This article is confidential and may not be copied, distributed, or reproduced in any form for any purposes without prior consent provided by SafeRE. SafeRE is neither licensed nor regulated by the Monetary Authority of Singapore and does not manage, advise, or distribute any investment product nor provide any financial advice to anyone.