The landscape of real estate investments is a complex arena, filled with diverse opportunities and distinct risk profiles. It’s crucial for potential investors to carefully evaluate this landscape and understand the nature of these varying investment types, from residential and commercial properties to logistics or hospitality real estate.

SafeRE offers Core, Core Plus, Value-Add, and Opportunistic real estate investments that help investors choose the right opportunities for their unique investment goals. Exploring such investment categories with SafeRE can help them choose the right balance of risk and reward in their portfolios.

In the face of global market uncertainty, rising redemption requests, and the potential impacts of the denominator effect [1], building or managing a real estate portfolio can be a complex task. Today, we will explain these terms and take a deep dive into their meaning. Whether you are a novice real estate investor or looking to diversify your portfolio, by the end of this read, you will be well-equipped to identify the investment class that aligns with your goals and explore the right opportunities with SafeRE.

Understanding Core, Core Plus, Value-Add, and Opportunistic Investments

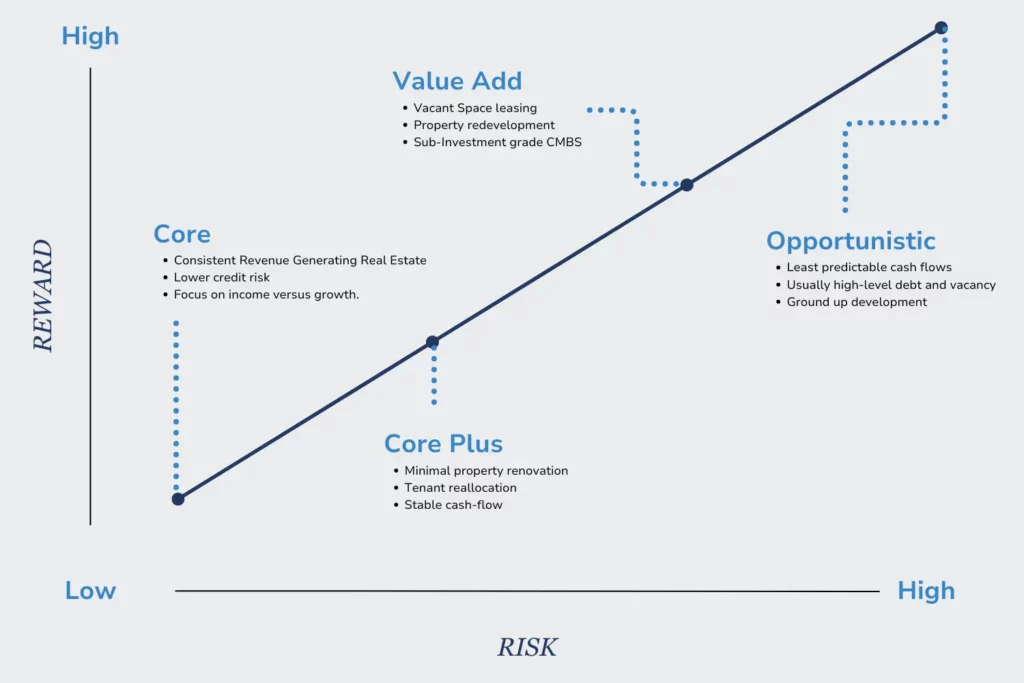

Core, Core Plus, Value-Add, and Opportunistic are terms used to define the risk and return characteristics of a real estate investment. The correlation between risk and reward [2] shows the range from conservative to aggressive and is defined by both the physical attributes of the property and the amount of debt used to capitalise on a project. SafeRE offers multiple investment options that fall under such categories. Whether you’re looking for a low-risk investment or a high-risk, high-reward opportunity, SafeRE has a variety of options that cater to different risk profiles.

Let us dive into the individual meaning and characteristics of each category.

Core

Core investments in real estate are akin to a safe harbour, offering stability and low risk.

They focus on fully leased, well-maintained properties in prime markets, providing steady cash flow and capital preservation. While they may not yield as high as other real estate opportunities, they are typically categorised as low-risk investments, with an attractive risk-reward balance, especially when compared to corporate bonds and publicly traded equities. Debt levels for Core investments are often kept below 50% to keep the risk level very low. Despite not being as liquid as exchange-offered securities, they are the most liquid investments in real estate, making them a reliable choice for investors.

Key Features of Core Investments:

- Risk level: Low

- Reward: Moderate

- Timeframe: Long-term

- Investment Goal: Consistent cash flow with the potential to grow.

While Core investments may not see a significant appreciation in value, they offer stable, predictable cash flows and low risk.

Core Plus

Core Plus investments in real estate are a step up from Core investments, involving slightly higher risk for potentially greater returns.

Typically they involve properties that are older or located in less desirable but up-and-coming areas, requiring more active management and maintenance. The use of higher debt leverages up to 70%, also increases both the risk and potential reward.

For instance, a Core Plus investment might be a 20-year-old rental property in a growing neighbourhood, purchased with a 40% down payment. While it is currently in good condition, it may require upgrades soon. This strategy aims for higher annual returns, offering a different balance between risk and reward.

Key Features of Core Plus Investments:

- Risk level: Low – Moderate

- Reward: Moderate

- Timeframe: Long-term

- Investment Goal: Strong cash flow with a strong growth rate

Though carrying a slightly higher risk, Core Plus investments offer the potential for increased returns alongside steady cash flow.

Value-Add

Value-Add investments in real estate typically focus on properties with existing cash flow but with the potential for enhancement.

The potential return on the investment can be achieved through property improvements and extensions, leasing of vacant spaces, or better management practices. The goal is to increase the net operating income, leading to an appreciation in property value. These investments often involve higher leverage to boost returns.

Key Features of Value-Add Investments:

- Risk level: Low – Moderate

- Reward: Moderate-High

- Timeframe: Short-term

- Investment Goal: Strong cash flow with a strong growth rate

While Value-Add projects can offer higher returns than Core investments due to value appreciation, they also carry more risk. If the execution of the business plan falls short, it could lead to lower-than-expected returns. However, for many investors, Value-Add projects strike the right balance between risk and return, offering immediate cash flow with substantial upside potential.

Opportunistic

Successful opportunistic investments, despite the risks, can yield higher returns to investors than Core or Value-Add strategies, primarily through substantial appreciation in value.

Opportunistic real estate investments are a step further on the risk spectrum, often involving properties that require significant rehabilitation or development from scratch. These properties may be completely vacant at the time of acquisition, offering the highest potential returns if the business plan is successful. However, they also carry the most risk due to the lack of in-place cash flow and the complexity of the business plans. Sponsors of these projects typically employ high leverage and may face less favourable debt terms and higher interest rates than more stabilised properties.

Key Features of Opportunistic Investments:

- Risk level: Moderate-High

- Reward: High

- Timeframe: Mid-Long Term

- Investment Goal: Strong cash flow and growth

Traditionally, opportunistic real estate investing was a domain for professional developers and private partnerships. Today, investors can invest in highly rewarding investment opportunities offered by well-established and trustworthy real estate equity firms. SafeRE exemplifies this paradigm shift, offering a seamless, digital, and secure pathway to accessing such opportunities, thereby mitigating risk while reaping the rewards they hold.

Exploring Asset Classes

Student accommodation (Core Plus/Value Add)

This is an asset class that shows promising growth. The demand for student housing is being driven by changing demographics and the growing middle class, as well as increasing local and international student enrolment. There is an upward trend in the number of international students migrating, and many universities cannot meet the accommodation needs of their student population. With SafeRE, investors can easily access such opportunities and invest in student accommodation.

Hospitality (Opportunistic)

The hospitality real estate sector presents a unique, opportunistic investment landscape. With the gradual recovery from the global pandemic and the resurgence of travel and tourism, there is a growing demand for innovative and experiential hospitality services. This sector is ripe for transformation, and properties that can adapt to changing consumer preferences can yield significant returns. SafeRE offers investors to tap into the hospitality market, leveraging our expertise to navigate this dynamic and rewarding asset class.

Logistics (Core Plus)

The logistics sector has seen a surge in demand, driven by the exponential growth of e-commerce and the need for efficient supply chain solutions. This has led to a rise in the value of strategically located logistics properties, making them a compelling investment opportunity. These properties, often located in or near major urban centres, facilitate the rapid movement of goods, making them crucial in today’s fast-paced, delivery-centric economy. With SafeRE, investors can explore the robust and resilient industrial and logistics real estate market, capitalising on the sector’s growth trajectory.

Aligning Real Estate Investment Strategies with Your Financial Goals and Risk Tolerance

Historical returns show that while all assets, including real estate and other traditional investments, experience volatility, the long-term benefits of certain real estate assets are evident. Real estate can limit portfolio volatility and provide a hedge against inflation. However, any real estate investment decision must reflect individuals’ investing goals and risk tolerances.

Real estate assets offer risk-adjusted returns, but investment choices should align with individual risk appetite and return expectations. From conservative Core portfolios to riskier Value-Add or Opportunistic strategies, understanding these strategies is crucial. By comprehensively evaluating your risk tolerance, investment goals, and the range of investment opportunities available, you can make informed decisions that align with your financial objectives. SafeRE simplifies decision-making by clearly identifying the strategy used in each offering, enhancing access and transparency in these investment classes.

SafeRE helps you invest in a wide variety of real estate opportunities. We bring you products that cater to all sorts of risk tolerance levels and investment expectations. However, investors should be aware of their investment period, the amount they can invest, and the returns they are seeking, and take their investment decision accordingly.

References

[1] https://www.nasdaq.com/articles/denominator-effect-public-markets-volatility-fundraising

[2] https://www.preqin.com/academy/lesson-4-asset-class-101s/real-estate

Disclaimer: This is not an advertisement making an offer or calling attention to an offer or intended offer for the purchase or sale of securities, units in a collective investment scheme or any other financial product. Neither this article nor anything contained herein shall form the basis of any contract or commitment whatsoever and should not form the basis of any investment decision and should not be considered as advice or recommendation by SafeRE Pte. Ltd. (“SafeRE”), its affiliates, representatives, directors, managers officers, employees, agents, to acquire any investment product.

The information contained herein is for informational purposes only and should not be construed as financial advice or a recommendation or an endorsement of any particular investment or investment portfolio or strategy. Nothing in this material has been independently verified to ensure its accuracy and fairness. Nothing in this material should be relied upon as a representation or warranty on any matter. In considering the suitability of any investment or other product mentioned herein, recipients of this material should bear in mind that past performance is no guarantee of future results, and any forward-looking statements, predictions or projections are subject to market influence and matters outside the control of SafeRE. Recipients should consult their own advisors.

This article is confidential and may not be copied, distributed, or reproduced in any form for any purposes without prior consent provided by SafeRE. SafeRE is neither licensed nor regulated by the Monetary Authority of Singapore and does not manage, advise, or distribute any investment product nor provide any financial advice to anyone.