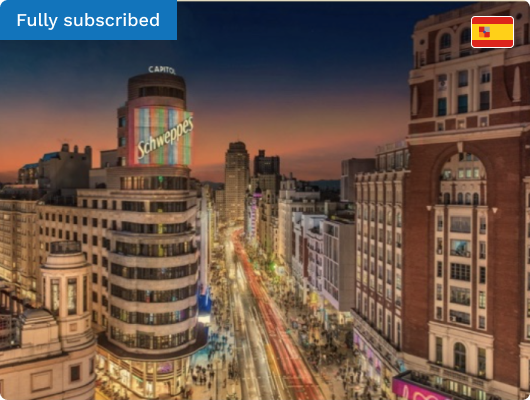

Aloft Madrid

Conversion of office building in the centre of Madrid, sold to Henderson Park

- This hotel opened in June 2019, after a 3-year renovation period, fully booked from the first day. It is a 4+ star property with 139 keys and is under management by the leading global hotel operator.

- The Fund Manager acquired the former office building off market in 2016 by directly approaching the owner through our extensive network of contacts. We obtained exclusivity and avoided a competitive bidding process.

- With its location in the heart of Madrid’s touristic and commercial activity, we identified the building as having potential to convert into a hotel.

- The Fund Manager secured bank financing, appointed advisors, project managers, architects, consultants, construction firm and future operator. We then secured the permit for use and conversion to a hotel.

Highlights

€ 30 Million

Purchase Cost

€ 15 Million

Conversion Cost

€ 58 Million

Disposition Value

3.5 Years

Holding Period

€ 20 Million

Equity

€ 13 Million

Capital Gain

15%+

IRR